How to Build an Emergency Fund in 6 Months

Life is unpredictable, and having an emergency fund is your financial safety net. Whether it’s a sudden car repair, medical expense, or job loss, an emergency fund prevents you from relying on credit cards or loans. With the right strategy, you can build a solid emergency fund in as little as 6 months.

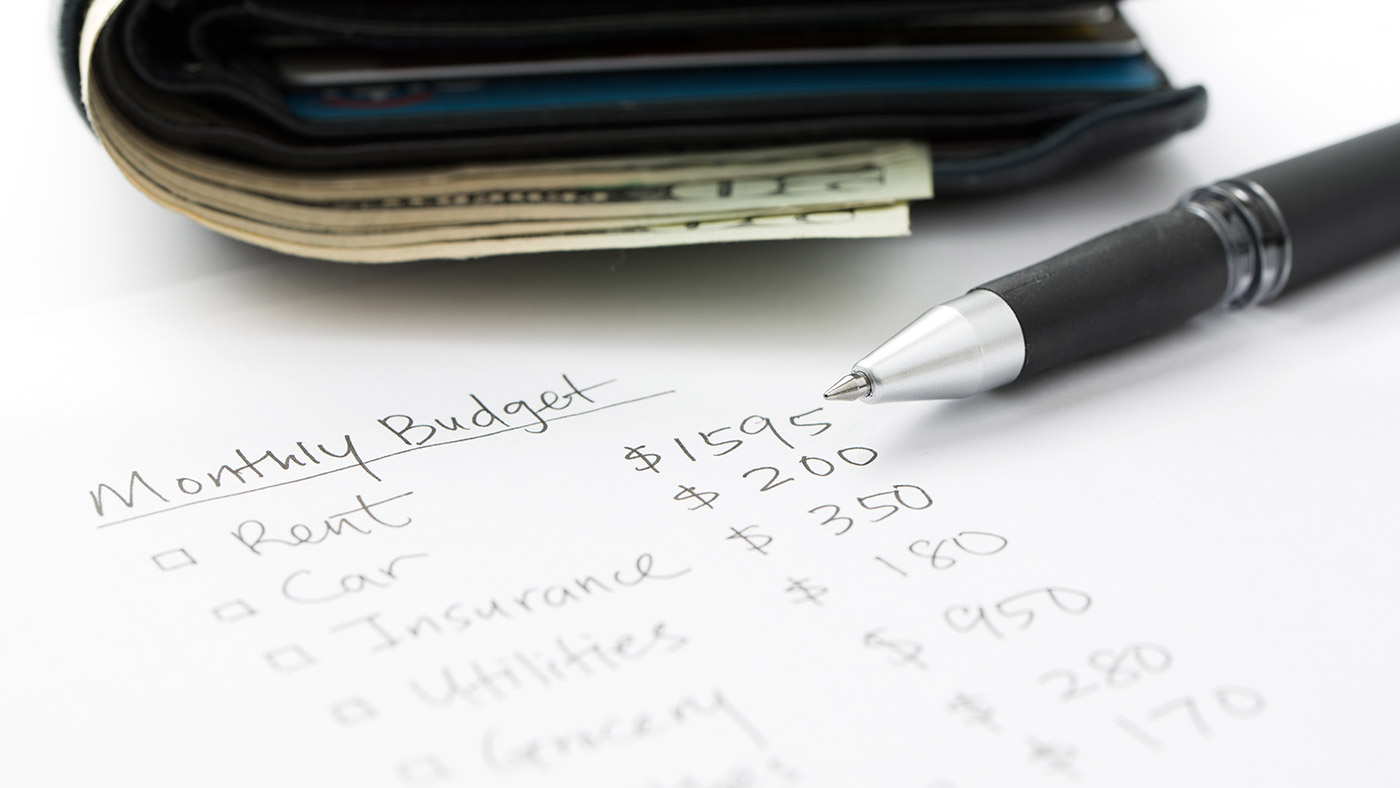

1. Set a Realistic Savings Goal

Financial experts recommend saving 3–6 months of living expenses. Start with a smaller milestone, like $1,000, to stay motivated, then build toward your full goal over time.

2. Open a Separate High-Yield Savings Account

Keep your emergency fund separate from your main checking account to avoid temptation. Use a high-yield savings account so your money earns interest while it sits untouched.

3. Cut Non-Essential Expenses

Review subscriptions, dining out habits, and online shopping. Canceling unused memberships and limiting takeout could free up $100–$300 per month for savings.

4. Automate Your Savings

Set up an automatic transfer each payday to make saving effortless. Even $50–$100 per week adds up quickly and removes the temptation to spend first.

5. Use Windfalls and Extra Income

Tax refunds, bonuses, or side hustle income should go directly into your emergency fund. Treating these as “extra money” accelerates your 6-month goal.

Key Takeaway

Building an emergency fund takes discipline, but by combining automated savings, cutting expenses, and using extra income wisely, you can achieve peace of mind and financial security in just 6 months.