Should You Pay Off Debt or Invest First?

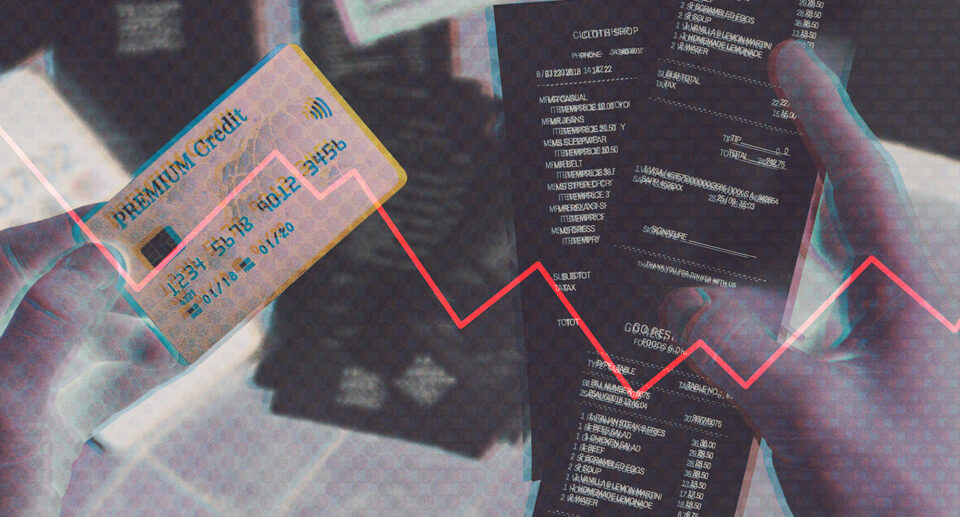

When you come into extra cash—whether it’s from a tax refund, bonus, or side hustle—the question often arises: should you use it to pay off debt or start investing? The right choice depends on interest rates, your financial stability, and your long-term wealth-building goals. This guide will help you make the smartest decision for your situation.

1. Evaluate Your Debt Interest Rates

High-interest debt is one of the biggest barriers to financial freedom. If you have credit card balances with rates of 18% or more, paying them off can deliver a guaranteed return that beats most investments. Eliminating high-interest debt first is often the fastest path to improving your net worth.

For comparison, the S&P 500 has averaged around 7–10% annual returns historically, far less than most credit card rates.

2. Look for Low-Risk Investment Opportunities

If your debt has a low interest rate—such as a student loan at 4% or a mortgage at 5%—you might consider investing first. Modern investing platforms make it easy to start with small amounts:

- Fidelity for low-cost index funds

- Vanguard for long-term retirement investing

- M1 Finance for automated, diversified portfolios

Even starting with $50–100 per month can compound into significant wealth over time.

3. Combine Strategies for Maximum Impact

For many people, the best approach is a hybrid strategy:

- Pay the minimum on all debts to stay current

- Use extra cash to eliminate high-interest debt first

- Start investing any remaining funds in retirement or taxable brokerage accounts

This allows you to reduce financial stress while also growing your future wealth. If your employer offers a 401(k) match, consider contributing at least enough to capture the free money before aggressively paying off lower-interest debt.

4. Don’t Forget the Emotional Side of Money

Numbers aren’t the only factor. Carrying debt can create anxiety and mental stress. Many people prefer to pay down debt first simply for peace of mind, even if the math suggests investing could produce higher returns. The best plan is the one you can stick to consistently.

Bottom Line

Pay off high-interest debt before investing. Once your debt is under control, focus on consistent investing to grow long-term wealth. A balanced approach that prioritizes debt payoff while taking advantage of key investment opportunities is often the best path to financial freedom.