How to Build an Emergency Fund from Scratch

An emergency fund is your first line of defense against unexpected financial disasters. Job loss, medical bills, car repairs—these are all stressful enough without the added burden of scrambling for money. According to a 2023 Bankrate survey, 57% of Americans cannot cover a $1,000 emergency with savings. Building an emergency fund can turn that stress into peace of mind.

Why You Need an Emergency Fund

Your emergency fund acts as a financial safety net. Without it, a single unexpected expense can force you to rely on high-interest credit cards or personal loans. This often leads to a debt spiral that’s hard to escape.

“Your emergency fund is not just cash—it’s your financial confidence.”

By having at least three to six months of living expenses saved, you protect yourself from life’s inevitable surprises.

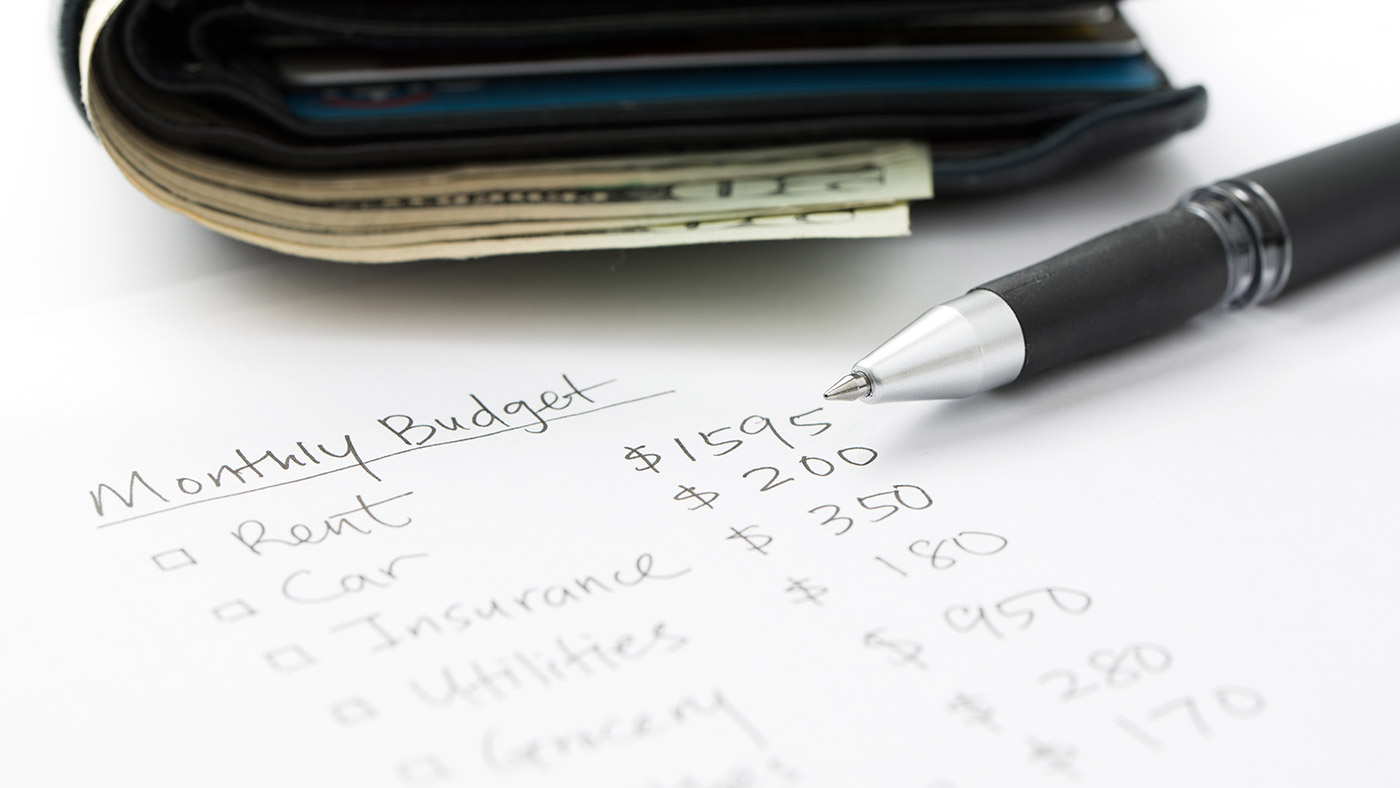

Step 1: Determine Your Savings Goal

Start by calculating your monthly essential expenses, such as:

- Rent or mortgage

- Utilities and internet

- Groceries and basic transportation

- Insurance and minimum debt payments

Multiply that total by three to six months for your initial emergency fund target. For example, if you spend $2,000 monthly, aim for $6,000 to $12,000.

Step 2: Start Small and Build Momentum

Saving thousands of dollars can feel overwhelming. Instead, focus on small wins first:

- Set an initial goal of $500 for immediate emergencies like car repairs or a medical co-pay.

- Celebrate milestones—every $100 saved is a step closer to financial freedom.

Consider using automatic transfers to move money into a dedicated savings account each payday. Online banks like Ally and Capital One 360 offer high-yield accounts that help your savings grow faster.

Step 3: Cut Unnecessary Expenses

To free up cash for your emergency fund, start by identifying expenses you can trim without harming your quality of life:

- Cancel unused subscriptions or switch to free alternatives.

- Cook at home 2–3 nights more per week to save $50–$100 monthly.

- Negotiate bills like internet or cell phone plans.

Every dollar saved can be redirected to your emergency fund, accelerating your progress.

Step 4: Boost Income to Reach Your Goal Faster

Sometimes cutting costs isn’t enough—you need to earn more. Consider these income-boosting methods:

- Pick up a weekend side hustle (food delivery, freelance work).

- Sell unused items on eBay or Facebook Marketplace.

- Offer microservices on Fiverr or Upwork.

Step 5: Protect and Maintain Your Fund

Once you’ve built your emergency fund:

- Keep it in a separate account to avoid impulse spending.

- Replenish it immediately if you need to use it.

- Avoid investing it in volatile assets like stocks—it needs to be liquid.

“Your emergency fund should be boring. Safety and accessibility come before high returns.”

Final Thoughts

Building an emergency fund takes discipline, but the payoff is immense. Start with a small goal, cut unnecessary expenses, and increase your income when possible. In a few months, you’ll have the financial buffer you need to face life’s surprises without fear.