Figma IPO: How Its Historic Debut Redesigned the SaaS Landscape

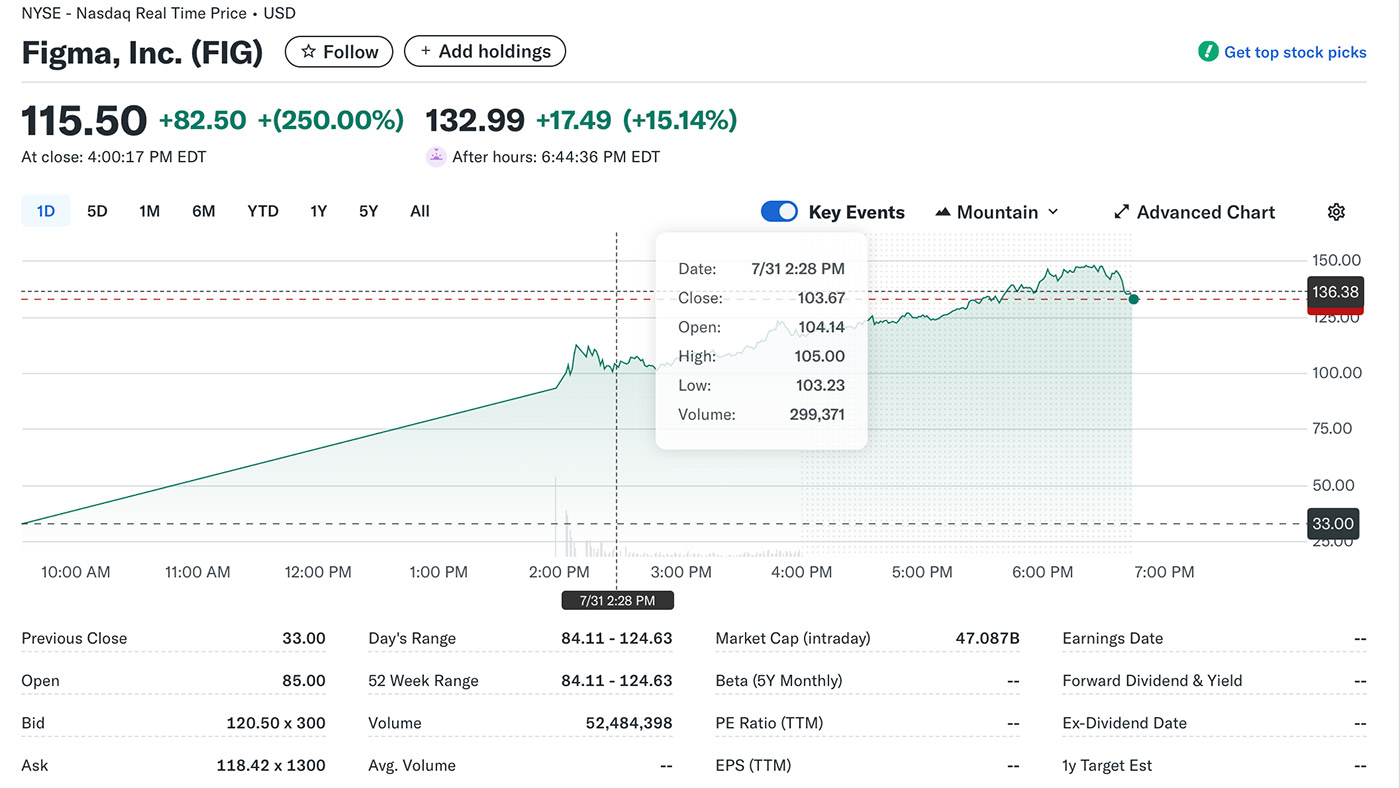

On July 31, 2025, Figma made one of the most impressive IPO debuts of the year, raising $1.2 billion at $33 per share. Shares opened at $85 and surged over 250%, closing near $115.50—a stunning outcome that valued the company at nearly $50–$68 billion within hours.

Why Figma Was the Most Anticipated Tech IPO in Years

Figma operates a collaborative, cloud-based design platform used by over 13 million monthly users and across 95% of Fortune 500 companies. In 2024, it generated $749 million in revenue—a 48% year-over-year increase—and posted a net income of $44.9M in Q1 2025. The IPO marks the largest U.S. VC-backed tech offering since 2021.

“Fast‑growing software IPOs have been extremely rare over the past three years, so deals like this tend to attract massive attention.” — Matt Kennedy, Renaissance Capital

Major Highlights of the IPO Day

- Demand was oversubscribed nearly 40×, making the IPO the hottest tech debut of 2025.

- Shares opened on NYSE at $85, jumped to as high as $124.63, and ended around $115.50.

- Figma achieved a post-IPO valuation between $50B–$68B—far above its previous private valuation near $19B.

Why the IPO Matters for Tech and SaaS

Figma’s success is seen as a bellwether moment for venture-backed tech, reviving investor confidence in high-growth software listings. After a multi-year IPO drought, Figma’s performance signals stronger market appetite for SaaS offerings.

It also cemented Figma’s dominance after Adobe’s failed $20B acquisition attempt in 2023. Figma reportedly received a $1B breakup fee and went public at a valuation exceeding that offer.

What Investors and Founders Gained

Key venture investors like Index Ventures, Greylock, Sequoia, and Kleiner Perkins saw huge gains—some post-IPO holdings exceeded $6–7 billion in value. The Marin Community Foundation received approximately $440M from gifted shares by co-founder Evan Wallace.

Key Takeaways

Figma’s IPO stands out for its explosive initial return, strong fundamentals, and signaling effect on the broader SaaS market. It reaffirms investor hunger for high-growth, AI-enhanced software firms and sets a benchmark for upcoming IPOs like Canva, Rippling, and Databricks.