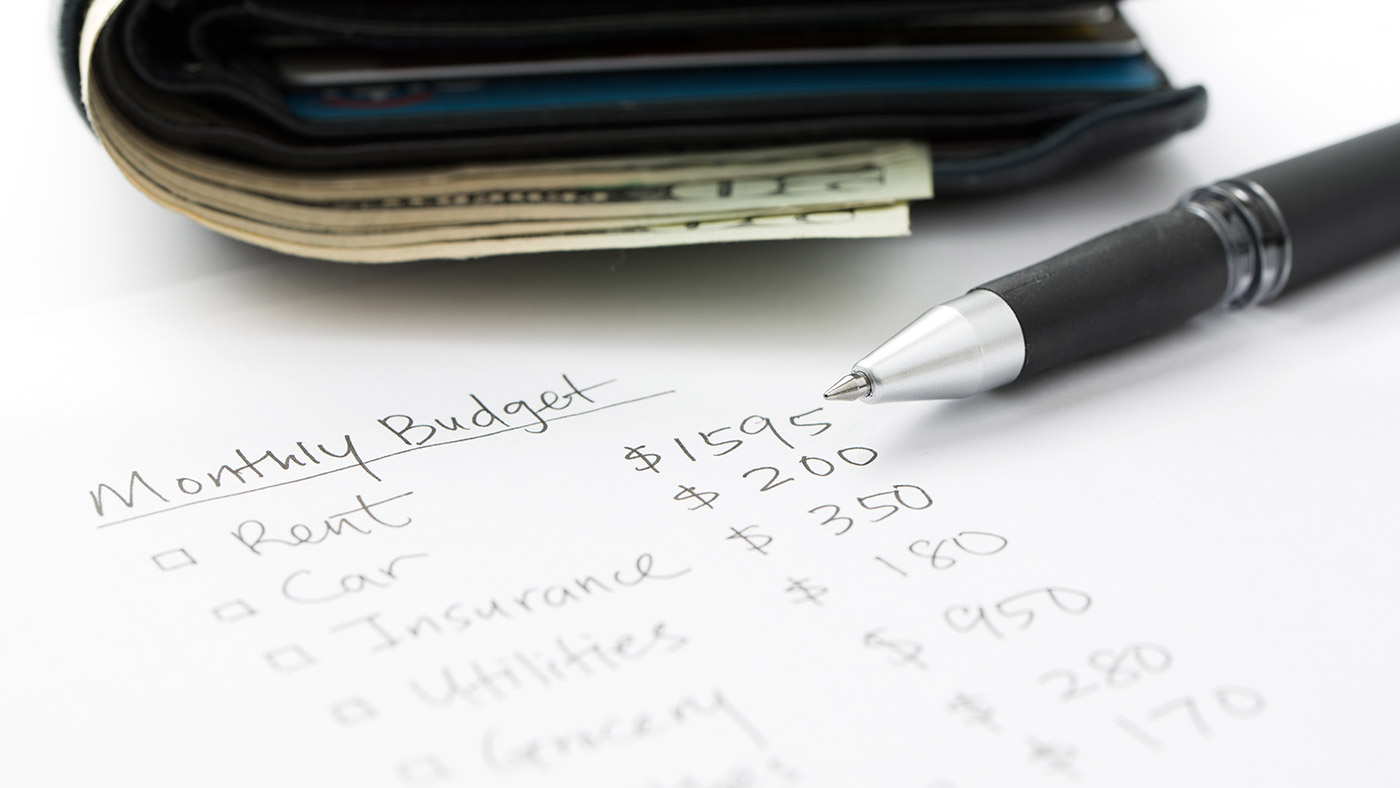

7 Budgeting Hacks to Save $500 This Month

Saving money doesn’t have to feel impossible. By making small, intentional changes, you can cut unnecessary spending and easily save $500 this month. These simple budgeting hacks can make a big difference in your financial health without requiring a huge lifestyle change.

1. Audit Your Subscriptions

Start by reviewing your last two months of bank and credit card statements. Look for subscriptions you don’t use regularly—like streaming services, gym memberships, or apps that quietly auto-renew.

Canceling just two or three unused services can free up $50–$100/month. If you still want some entertainment, consider sharing accounts with family or switching to free ad-supported plans.

2. Switch to a Cash-Only Week

Going cash-only for a week forces you to see where your money goes. Withdraw a set amount—like $100 for groceries and $50 for personal spending—and use only cash.

This method limits impulse buys and makes you more mindful. People often save $50–$75 just by skipping small, unplanned purchases.

3. Cook at Home and Pack Lunch

Dining out can cost 3–5 times more than cooking at home. If you normally buy lunch during the week and grab dinner out on weekends, switching just three meals to home-cooked options could save $120–$180/month.

Batch cooking on Sundays or using a slow cooker can make this change realistic, even with a busy schedule.

4. Negotiate Your Bills

Many people pay more than they need to for internet, cable, or cell service. Call your providers and ask if there are current promotions or loyalty discounts.

Spending 10–15 minutes on the phone can lower your bill by $20–$50/month. Some people also save by bundling services or switching to autopay discounts.

5. Use Cashback and Rewards Apps

Apps like Rakuten, Ibotta, and Dosh give cash back on everyday purchases. Stack these rewards with store loyalty programs to maximize your savings.

Even if you earn just $5–$10 per week, that’s $20–$40/month in effortless savings. Link your debit or credit card and watch the cash back add up automatically.

6. Set a 24-Hour Rule for Purchases

Impulse spending can destroy a budget. Commit to a simple rule: wait 24 hours before buying anything that isn’t essential. Often, the urge passes, and you avoid unnecessary expenses.

Even skipping just two $50 impulse purchases saves $100 a month instantly.

7. Automate Your Savings

Set up a recurring transfer from your checking account to a separate savings account. Even $25–$50 per week adds up to $100–$200/month without thinking about it.

Consider using a high-yield savings account to make your money grow faster with interest.

Key Takeaway

By combining these hacks—canceling unused subscriptions, negotiating bills, cooking at home, and automating savings—you can realistically save $500 or more in 30 days. Small, consistent changes have a big impact on your financial freedom.