Credit Card Churning: How to Travel for Free Without Hurting Your Credit

Credit Card Churning: How to Travel for Free Without Hurting Your Credit

Imagine flying first class to Europe, staying in luxury hotels, and enjoying free rental cars — all without spending a dime on the actual travel. For many savvy travelers, this dream is made possible through credit card churning, a strategy that takes advantage of generous credit card welcome bonuses. While it can be a game-changer for frequent flyers and travel enthusiasts, it can also backfire if not managed carefully.

In this guide, you’ll learn what credit card churning is, how to do it responsibly, and which cards to consider in 2025 for maximum rewards.

What Is Credit Card Churning?

Credit card churning is the practice of opening new credit card accounts to earn sign-up bonuses, which often come in the form of airline miles, hotel points, or cash back. Once you hit the required spending threshold to earn the bonus, some churners either keep the card for its perks or close it before the next annual fee hits. They then repeat the process with another card.

Example: You open a credit card offering 60,000 airline miles after spending $3,000 in the first 3 months. Those miles might cover a round-trip international flight, giving you nearly free travel just for spending on everyday purchases.

When done correctly, credit card churning can result in thousands of dollars in free travel every year. However, it’s not without risk, as opening and closing multiple accounts can impact your credit score if you’re not careful.

How to Churn Credit Cards Without Hurting Your Credit

Churning is all about strategy and discipline. Follow these steps to maximize rewards while protecting your credit score:

- Check Your Credit First: Before diving into churning, ensure you have a strong credit score — ideally 700 or higher. Banks are more likely to approve you for premium travel cards if your credit is solid.

- Pay Off Balances in Full: Carrying a balance with high interest can quickly erase the value of any rewards you earn. Always pay off your cards in full each month to avoid interest and protect your credit score.

- Space Out Applications: Opening too many cards at once can trigger red flags with banks and result in denied applications. Space out new card applications by at least 90 days to 6 months.

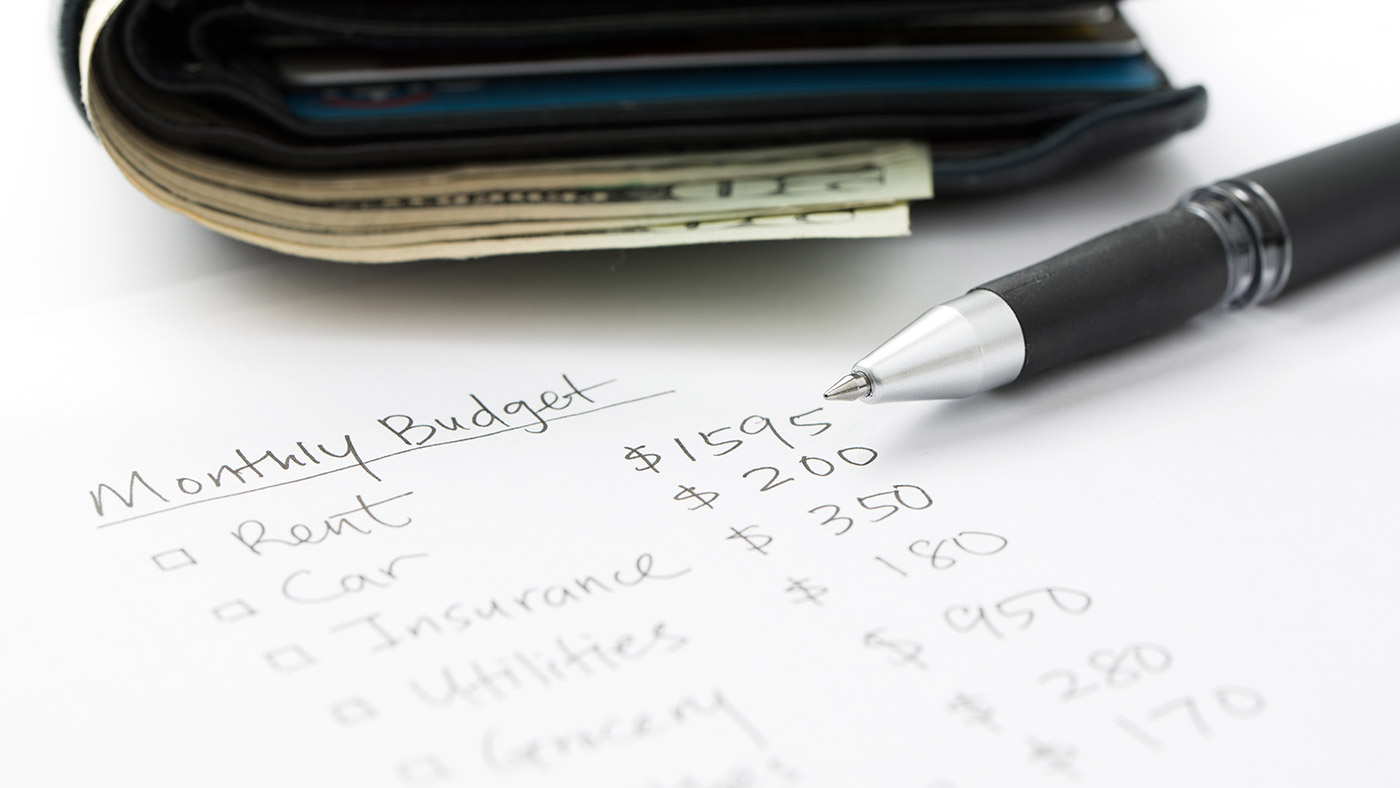

- Track Spending Requirements: Most sign-up bonuses require a minimum spend (e.g., $3,000 in 3 months). Missing that target means you won’t earn the bonus. Consider using budgeting apps to track progress.

- Keep Old Cards Open: Your credit score benefits from a long credit history. Even if you close newer cards, keep your oldest credit cards open to maintain your average account age.

In short, responsible churning is about timing, organization, and financial discipline. Treat it like a calculated game, not a free-for-all.

Best Credit Cards to Start Churning in 2025

Choosing the right cards is crucial for maximizing rewards. Here are some popular options for new churners in 2025:

- Chase Sapphire Preferred® – Earn 60,000 bonus points after meeting the minimum spend requirement. Points are flexible and can be transferred to major airlines and hotel programs.

- Capital One Venture Rewards® – Earn 75,000 miles after $4,000 spend. Great for those who want simple travel redemptions with no blackout dates.

- American Express Gold® – Earns high rewards on dining and groceries, making it easy to hit the spending requirement quickly. Ideal for everyday spenders who also want travel perks.

Pro Tip: Pair your credit card churning strategy with a budgeting tool like

Rocket Money to track subscriptions, expenses, and upcoming annual fees so you never miss a bonus deadline.

Organizing Your Credit Card Churning Strategy

Managing multiple credit cards can get overwhelming fast. To keep your strategy organized:

- Create a spreadsheet with card names, approval dates, spending requirements, and bonus deadlines.

- Set calendar reminders for annual fee dates and minimum spend deadlines.

- Automate bill payments to avoid late fees or missed payments.

- Track your points and miles in apps like AwardWallet or CardPointers.

Organization is the difference between free vacations and costly mistakes. Many churners use multiple tools to ensure they never miss a reward.

Is Credit Card Churning Right for You?

Credit card churning isn’t for everyone. It requires excellent financial discipline, strong credit management, and the ability to pay balances in full each month. If you live paycheck to paycheck or often carry debt, churning could do more harm than good.

However, if you are financially responsible and love to travel, churning can unlock incredible perks: free flights, hotel stays, lounge access, and even rental car upgrades. With careful planning, you could be sipping espresso in Rome or relaxing on a Caribbean beach — all funded by credit card bonuses.

Final Thoughts

Credit card churning is a powerful strategy for earning free travel, but it must be approached with caution. Start slow, pick the right cards, pay your balances in full, and stay organized. If done responsibly, churning can be your ticket to exploring the world without emptying your wallet.

Disclaimer: Credit card offers, bonuses, and terms are subject to change. Always verify current details with the card issuer before applying.