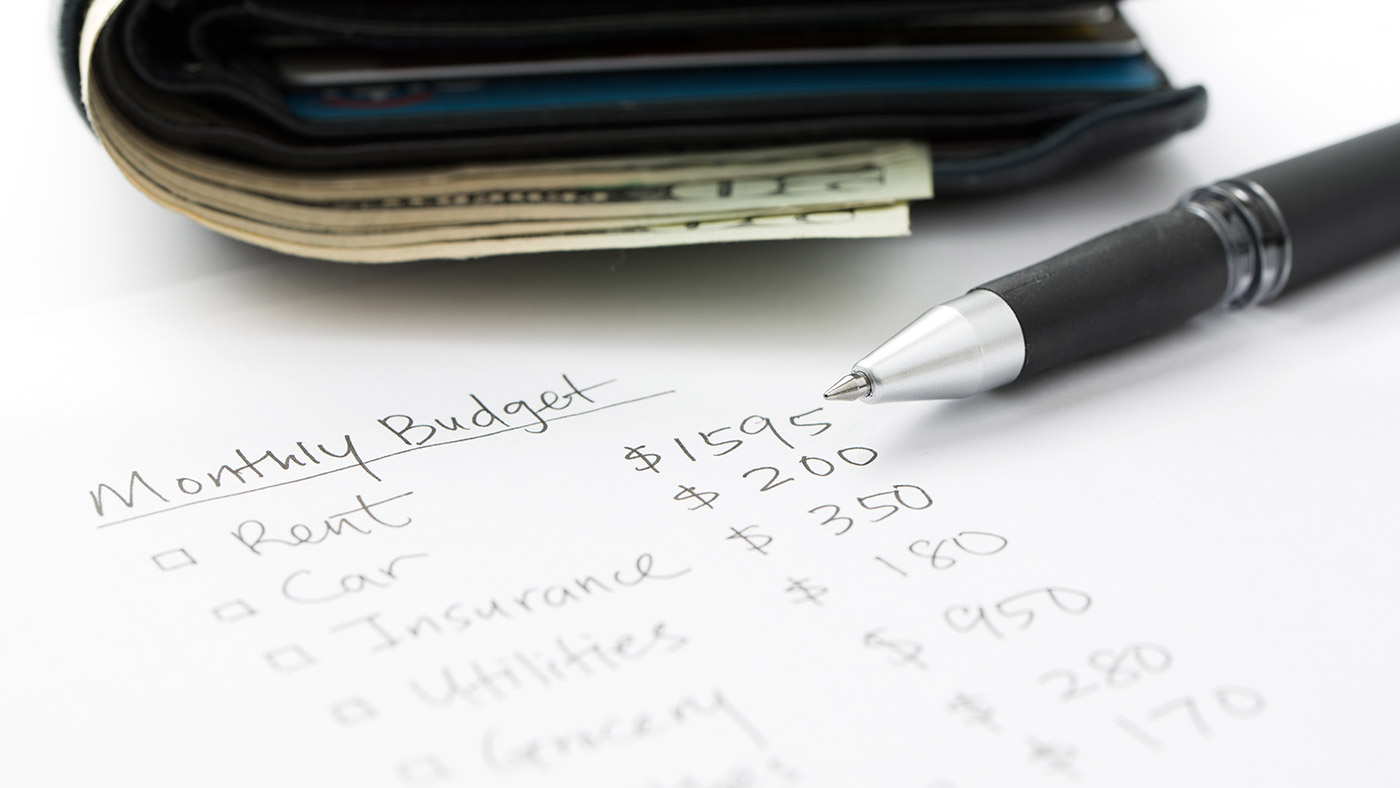

How to Get Approved for a Credit Card With No Credit History

Getting your first credit card can feel like a catch-22. You need credit to get approved, but you need a credit card to build credit. The good news? There are strategies to get approved for a credit card with no credit history—and start building your financial foundation fast.

1. Start With a Secured Credit Card

A secured credit card is backed by a deposit, usually $200–$500, which acts as your credit limit.

- Almost anyone can qualify, even with no history

- Make on-time payments to start building credit

- Many banks will upgrade you to an unsecured card after 6–12 months of responsible use

2. Become an Authorized User

If a family member or close friend has a credit card with a positive history, ask to be added as an authorized user.

- You get the benefit of their payment history on your credit report

- You don’t even have to use the card to gain a boost

- Choose someone with low utilization and no missed payments

3. Consider a Student or Starter Credit Card

Many banks and issuers offer entry-level cards for people with little or no credit.

- Typically lower credit limits but easier to get approved

- Use for small recurring expenses like subscriptions to build history

- Pay in full each month to avoid interest

4. Use Alternative Credit-Building Tools

Fintech companies now offer products that help you build credit without a traditional card:

- Experian Boost – Adds utility and streaming bills to your credit report

- Self Credit Builder Loan – A small installment loan that reports payments to bureaus

- Rental reporting services – Report on-time rent payments to build history

5. Avoid Common Mistakes

- Don’t apply for multiple cards at once—hard inquiries can hurt your score

- Always pay at least the minimum by the due date

- Keep utilization below 30% to show responsible use

Key Takeaway

You can get approved for a credit card with no credit history by starting small—through secured cards, authorized user status, or starter cards. Build habits early, and within months, you’ll unlock more options with higher limits and better rewards.